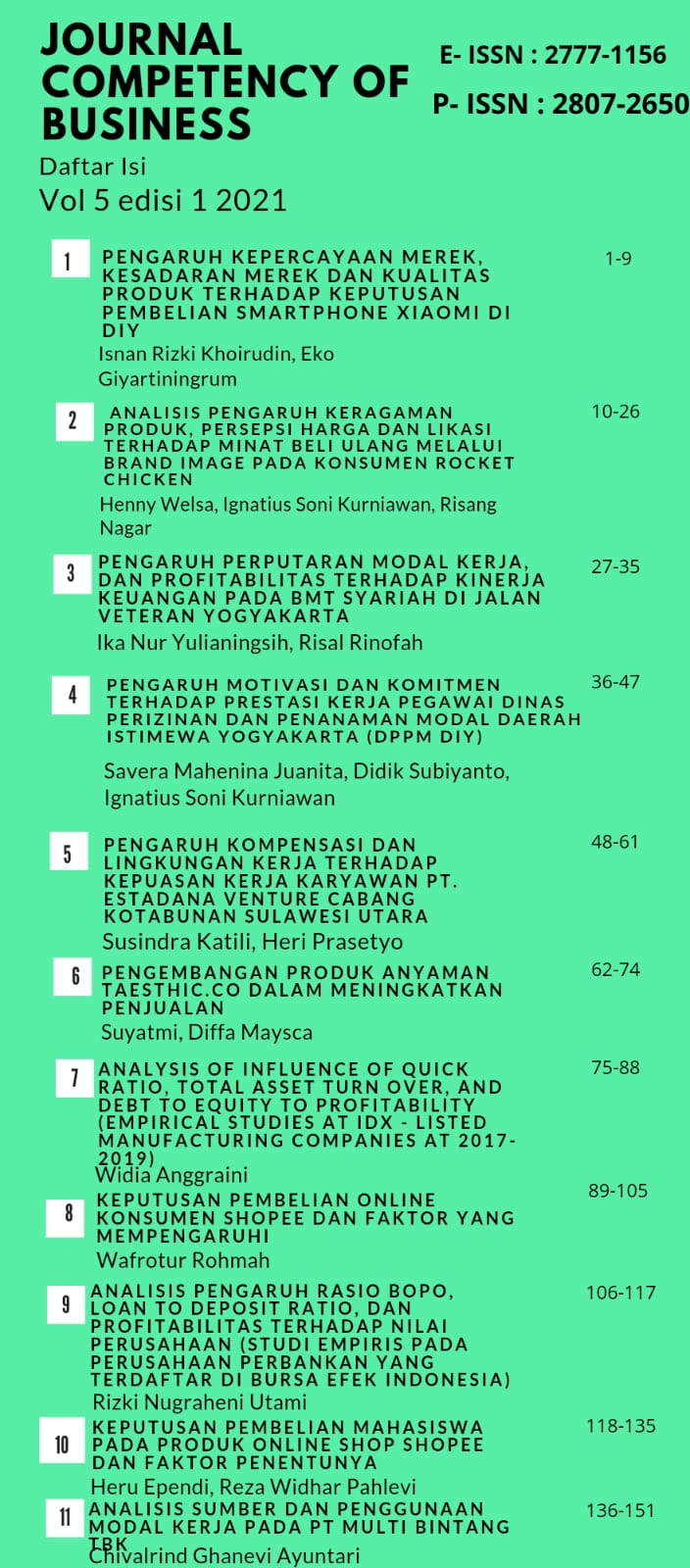

ANALYSIS OF INFLUENCE OF QUICK RATIO, TOTAL ASSET TURN OVER, AND DEBT TO EQUITY TO PROFITABILITY (EMPIRICAL STUDIES AT IDX-LISTED MANUFACTURING COMPANIES at 2017-2019)

DOI:

https://doi.org/10.47200/jcob.v5i1.876Keywords:

Quick Ratio, Total Asset Turn Over, Debt To Equity, Return On EquityAbstract

Profitability is a tool used to analyze management performance, the level of profitability will describe the company's profit position. Profitability ratio is the ratio used in assessing a company's capacity to earn profits based on its normal business activities. This study aims to determine the effect of the quick ratio, total asset turnover, and debt to equity on profitability.

The population of this research is manufacturing companies listed on the Indonesia Stock Exchange (IDX) for the 2017-2019 period. The companies sampled in this study were 34 manufacturing companies listed on the Indonesia Stock Exchange. The sampling technique used by researchers is non probability sampling with purposive sampling technique. This study uses a quantitative approach with data processing using the SPSS 25 for windows application.

The results of this study indicate that, (1) the quick ratio has a positive effect on return on equity, this is indicated by a significant value of 0.019 which means less than α = 0.05 with a coefficient value of 2.397. (2) total asset turnover has a positive effect on return on equity, this is indicated by a significant value of 0,000 which means it is smaller than α = 0.05 with a coefficient value of 2.184. (3) debt to equity has a negative effect on return on equity, this is indicated by a significant value of 0.008 which means it is smaller than α = 0.05 with a coefficient value of -2.762.

References

Abdilah, Budi. Juandi. (2019). Pengaruh Current Ratio, Debt to Equity Ratio dan Total asset Turn Over terhadap Return on Equity pada PT. Hutama Karya. Jurnal ilmu ekonomi, Vol. 2, No. 4.

Alarussi, Ali Saleh & Alhaderi, Sami Mohammed. 2018. Factors Affercting Profitability in Malaysia. International Journal of Economics Studies. Vo. 8, No. 3, hal. 1-16.

Ambri, Rahmi. Indrawan, Andri. & Sudarma, Ade. (2020). Pengaruh Total Debt Equity Ratio (Der) Dan Total Asset Turnover (Tato) Terhadap Profitabilitas (Roe) Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek. : Journal of Business, Management and Accounting Volume 1, Nomor 2.

Ayem, S. & Nugroho, R. (2016). Pengaruh Profitabilitas, Struktur Modal, Kebijakan Deviden, Dan Keputusan Investasi Terhadap Nilai Perusahaan (Studi Kasus Perusahaan Manufaktur Yang Go Publik di Bursa Efek Indonesia) PERIODE 2010- 2014. Jurnal Akuntansi, 4(1), 31-40.

Bisnis.com kinerja gudang garam, https://1234268/kinerja-gudang-garam.market.bisnis.com/read/20200429/192/. 29 April 2020.

Ferica. Nauli, Annisa. Couwinata, Cindy. & Sukheny. (2020). Pengaruh Likuiditas, Total Asset Turnover, Debt To Equity Ratio Dan Perputaran Persedian Terhadap Profitabilitas Perusahaan Manufaktur. Journal of Economic, Business and Accounting Volume 3 Nomor 2.

Ghozali, Imam. 2018. Aplikasi Analisis Multivariate dengan Program IBM SPSS 25. Badan Penerbit Universitas Diponegoro: Semarang

Hantono. 2015. Pengaruh Current Ratio dan Debt to Equity Ratio Terhadap Profitabilitas Pada Perusahaan Manufaktur Sektor Logam dan Sejenisnya Yang Terdaftar di Bursa Efek Indonesia Periode 2009-2013. Jurnal Wira Ekonomi Mikroskil Vol.5, No.1.

Harahap, S. S. (2016). Analisis Kritis Atas Laporan Keuangan. Cetakan Ke-13, Jakarta: Rajawali Pers.

Hendawati, H. 2017. Analisis Current Ratio, Debt to Equity Ratio dan Total Asset Turn Over Terhadap Return on Equity. Jurnal Sikap Vol.1, No.2

Hery, (2017), Akuntansi dasar 1 dan 2, Cetakan kedua, Jakarta : Grasindo.

Innocent, E.C., Mary, O. I., dan Matthew, O. M. (2013). Financial ratio analysis as a determinant of profitability in Nigerian pharmaceutical industry. International journal of business and management, 8(8), 107

Jessica. Lilia, Wirda. Leonardy, Cherlyn. Kartika, Meiluawaty. & Panggabean, Nehemia. (2019). Pengaruh ITO, CR, DER, TATO dan WCTO Terhadap ROE Pada Perusahaan Aneka Industri Terdaftar Di BEI. Berkala Akuntansi dan Keuangan Indonesia, Vol. 04, No. 02 (2019): 43-60.

Jogiyanto, H. (2017). Teori Portofolio dan Analisis Investasi. Yogyakarta: BPFE

Jumingan. (2017). Analisis Laporan Keuangan. Jakarta : PT Bumi Aksara.

Kasmir. 2018. Analisis Laporan Keuangan. Jakarta : Penerbit Rajagrafindo Persada.

Kontan.co.id sido muncul, https://kontan.co.id/news/sido-muncul-sido-akan-stock-split-dengan-rasio-12-bagaimana-prospeknya. 7 September 2020

Mahduh, H. & Halim, A. (2012), “Analisis Laporan Keuangan”. Yogyakarta: (UPP) STIM YKPN.

Mamduh, M.H. (2016). Manajemen Keuangan. Yogyakarta : BPFE

Nadhifa, Y. N. (2017). Pengaruh Current Ratio, Quick Ratio Dan Cash Ratio Terhadap Profitabilitas. Jurnal Ilmu dan Riset Manajemen Volume 6, Nomor 12.

Niresh, J. Aloy. (2012). Trade-off between liquidity dan profitability: A study of selected manufacturing firms in Sri Lanka. Researchers World, 3(4), 34

Pongrangga, Rizki, Adriani. Dzulkirom, Moch. Saifi, Muhamad. (2015). Pengaruh Current Ratio, Total Aset Turnover dan Debt to Equity Ratio Terhadap Return on Equity (Studi pada Perusahaan Sub Sektor Property dan Real Estate yang Terdaftar di BEI periode 2011-2014). Jurnal Administrasi Bisnis (JAB) Vol.25, No.2.

Pratomo, Adityo Joko. 2017. Pengaruh Debt to Equity Ratio (DER) dan Current Ratio (CR) Terhadap Return on Equity (ROE). Studi Empiris Pada Perusahaan Sub Sektor Kabel Yang Terdaftar di Bursa Efek Indonesia Pada Tahun 2013-2016. eJournal Administrasi Bisnis ISSN 2355-5408.

Rezeki, Sri. Dwinda, Lovelly. & Ramayani, Citra. (2016). Pengaruh Leverage Total Assets Turnover Dan Ukuran Perusahaan Terhadap Profitabilitas Perusahaan Food And Beverages Di Bursa Efek Indonesia.

Sopini, Pupu. (2015). Pengaruh Current Ratio, dan Quick Ratio Terhadap Profit Margin Pada PT. INDOSAT Tbk periode 2005-2014. Jurnal Ilmiah Dikdaya.

Staven, Peter. (2018). Pengaruh Current Ratio, Quick Ratio, Debt to Asset, Debt to Equity, Firm Size, dan Cash Ratio terhadap Profitabilitas Perusahaan Manufaktur di Bursa Efek Indonesia.

Sugiyono, (2019), Metode penelitian kuantitatif kualitatif dan R&D, Bandung : Alfabeta

Sujarweni, V. Wiratna, (2017), Aanalisa laporan keuangan (Teori, Aplikasi dan Hasil Penelitian), Yogyakarta: Pustaka Baru Press

Supardi, H., Suratno, H. S. H., & Suyanto, S. (2018). Pengaruh Current Ratio, Debt to Asset Ratio, Total Asset Turnover dan Inflasi Terhadap Return on Asset. JIAFE (Jurnal Ilmiah Akuntansi Fakultas Ekonomi), 2(2), 16-27.

Susilawati, Susi. Irawati, Riana. Mulana, M. (2017). Pengaruh Perputaran Persediaan dan Perputaran Total Aset Terhadap Profitabilitas Pada PT. Indofarma (Persero) Tbk. STAR-Study & Accounting Research Vol.XIV, No.1, ISSN 1693-4482.

Wahyuni, S. F. (2017). Peran kepemilikan institusional dalam memoderasi pengaruh current ratio, debt to equity ratio, Total asset turnover dan inventory turnover terhadap return on equity di Bursa Efek Indonesia. Jurnal Riset Finansial Bisnis, 1(2), 147-158.

Zulkarnaen, W., Fitriani, I. D., & Widia, R. (2018). The Influence of Work Motivation to Work Achievement of Employees in PT. Alva Karya Perkasa Bandung. Jurnal Manajemen, Ekonomi dan Akuntansi, 1(1), 42-62.